The inflation rate in Germany is expected to be +5.1% in February 2022…powered by spiraling energy prices.

“Inflation is like toothpaste. Once it’s out, you can hardly get it back in again.” – Karl Otto Pöhl, German economist, former President of the Bundesbank.

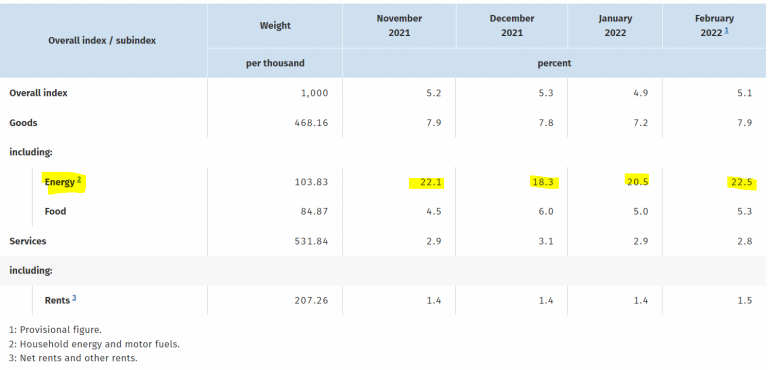

Late last year when it became clear to everyone else that inflation was taking off, German leaders and media insisted that it would only be a temporary phenomenon. But then last December inflation roared to 5.3%, the highest level in close to 30 years. In January, 2022, it eased slightly to 4.9%. But last month’s provisional figures show that it rose again to 5.1%. The inflation toothpaste is out to stay.

All this was well in the works – long before the Russian attack on Ukraine, which incompetent policymakers are desperate to use as a scapegoat. The bitter conflict is certain to make everything even worse. An economic nightmare threatens Germany and Europe.

Still blaming Covid

In its press release, the Federal Statistical Office (Destatis) blames “Covid-19-related effects such as delivery bottlenecks and significant price increases at upstream stages in the economic process” and “uncertainties caused by the Russian attack on Ukraine”, all while underplaying the role of energy costs.

But the table provided by the Federal Statistics Office clearly shows how energy inflation reached a new high last February, soaring to 22.5% year on year!

Not only has Germany shut down most of its existing nuclear power plants and aims to continue on mothballing its fleet of coal power plants, Chancellor Olaf Scholz announced he was suspending gas delivery from the Russian-German Nord Stream 2 natural gas pipeline, which will surely only further exacerbate Europe’s energy supply and potentially destabilize Europe’s economy.

The final results for February 2022 will be released on March 11, 2022.

[…] Germany’s Absurd Energy Policy Of Shortage And Hardship: Energy Inflation Soars To 22.5% Year … […]

“Inflation is the rate at which the value of a currency is falling and, consequently, the general level of prices for goods and services is rising.”

Need to have cause and effect in the right order!

Then ask, why is the value of currency falling?

Not too hard to find the answer, is it?

It depends on the amount of currency chasing the amount of product on the market. Supply and demand.

As the Government is printing and printing, it is the sole responsible agent for inflation.

Spot on.

In a free market, supply and demand can determine the price of an item. Supply and demand for an item has nothing to do with the

“value” of the currency in use.

Double the currency in circulation for a given quantity of goods ensures the price of each good will on average be doubled.

There is your inflation!

What about when the supply of an item is unable to meet demand, either because the supply falls, or the demand increases and supply is unable to keep pace (price increases either naturally or artificially)? And what if the cost of all other items depend on that one (fuel/energy)?

In the absence of a natural cause of the lack of a critical item, another cause of shortage can be self infliction (gross mismanagement).

Sure, more currency in circulation obviously makes prices rise, but not necessarily in the same way. In general, the inequities will be different in both cases.

Either way, it seems to me that your words are included in Pierre’s.

I don’t know why I didn’t do this to start with (late, tired).

“2. (Economics) economics a progressive increase in the general level of prices brought about by an expansion in demand or the money supply (demand-pull inflation) or by autonomous increases in costs (cost-push inflation).”

https://www.thefreedictionary.com/inflation

Advantage still Pierre.