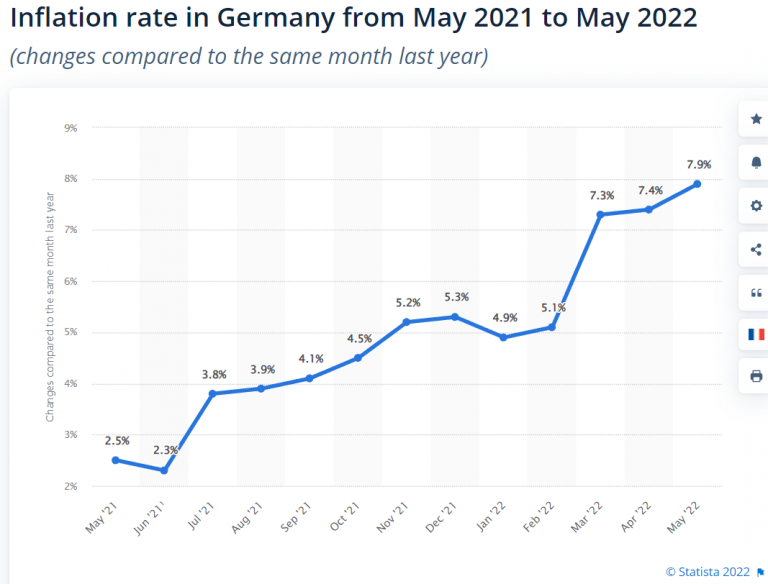

Zurich’s online NZZ daily warns that come autumn, inflation in Germany could reach “double-digit figures for the first time since 1951”.

The inflation rate in Germany in August rose to 7.9 percent, up from 7.5% a month earlier.

Chart source: Statista.

“At such a rate, the purchasing power of money melts like snow in the sun,” writes the NZZ. In early 2021, inflation was tame, near 2%, but then soared to over 5% by autumn – long before the start of the Ukraine war.

“In the euro zone as a whole, inflation is at a record high 8.9 percent.” reports the NZZ “So there can be no talk of the hoped-for easing of the situation. On the contrary, the situation in Germany is likely to get even worse.”

Tax breaks given earlier this year on fuel are running out today and heating gas levy hikes slated for October will continue to add to inflation in Germany, and across Europe.

August energy inflation: 36%!

The main driver behind Germany’s inflation are energy prices, which rose by almost 36 percent in August. The high costs of energy are pushing food prices up. No relief is in sight.

Though Europe’s incompetent leaders try to blame Vladimir Putin’s war in Ukraine for the economic woes, the NZZ reminds that “the field for above-average inflation rates had already been tilled beforehand.” The major factors driving inflation are extremely reckless monetary and energy policies. Things are about to get much uglier.

Shutting down reliable conventional power plants while gas supplies tighten and green energies fail to deliver has been a major driver of the whopping 36% energy inflation seen in August.

The European central bank (ECB) has also moved too slowly in raising its interest rates. On September 8th, it is expected the ECB will raise the rate another 0.5%. Too slowly, some experts warn.

It’s not as if there isn’t any

https://preview.redd.it/h6gqai9yx1m21.png?auto=webp&s=91b56862db26482f642dc1750ec0bc56e9f78b8a

The Great Depression of the early last century was also a worldwide phenomenon, likewise now as then brought on by economic policies set in place by ignorant arrogant incompetent fools.

Note added in support…

“Funny how the fastest rates of inflation happen in the sectors most depending on government funding:”

https://i0.wp.com/www.powerlineblog.com/ed-assets/2022/09/IMG_5577.jpeg?ssl=1

A concurrence of several issues produces a world in turmoil:

– Global warming, CO2, and Net-Zero,

– The concept of Russkii Mir (the Russian World),

– Continuous religions conflict,

– The Covid19 Panic,

– Anti-nuclear energy,

– “western” governments with no principles, and misplaced priorities.

Please explain how the raising of a price is the cause of inflation? If the supply of money is unchanged, a rise in price of an item means there is less money for other items. This doesn’t in and of itself increase the supply of money more than the rate of growth. Inflation is generated by the ones who control the money supply. A price rise of an item does not reduce the “value” of currency, but inflation sure does. A bit hard to figure, is why when consumers are facing increasing costs, do governments decide raising interest rates, which is another increased cost, is in any way helpful?

Don’t forget that the Regime Media is talking to herds of modern moron slaves.

To these herds the notion that inflation is being created since the last FINANCIAL TERRORIST ATTACK of 2007/8 particularly with the issuance of TRILLIONS of $€£ is not even a possibility.

To help THEM (SRF & Billionaires) even more they deployed tools like QQE, ZIRP and NIRP among others. All these tools have been creating the conditions for INFLATION. And after the OPERATION COVIDIUS controlled destruction of many sectors of the economy and now the use of sanctions are doing the rest.

Since this indicator is a very bad one (manipulated has they best see fit) of course that the rise of prices in the energy sector due to the sanctions is seem has “inflation”!

The Federal Reserve Bank has to reverse their policies that caused inflation in the first place. They have done so a few months ago, although are not moving fast in the other direction. Fed policy can be followed by looking at weekly data for Fed Balance Sheet every Thursday after the stock markets closes at 4:30 EST:

https://us.econoday.com/byshoweventfull.aspx?fid=541234&cust=us&year=2022&lid=0&prev=/byweek.asp#top

For the week ending last Friday, one week ago, from my blog:

“Federal Reserve Credit last week dropped $18.5bn to $8.819 TN. Fed Credit is down $71.1bn from the June 22nd peak. Over the past 154 weeks, Fed Credit expanded $5.092 TN, or +137%.”

+137% is a huge expansion of credit.

That’s why price inflation is so high.

Higher interest rates slow the demand for money (credit) which helps slow down the price inflation they caused by their monetary inflation. The root cause of monetary inflation is Federal Deficit Spending, which the Fed indirectly finances to reduce interest rates paid by the US Treasury.

Note: I have a Finance MBA and wrote an economics and finance newsletter for 43 years, from 1977 to 2020. I still post some charts and articles by other authors on my free ECONOMIC LOGIC blog, since 2008:

https://el2017.blogspot.com/

In 2020 I decided to focus on my Climate Science and Energy blog, which has had almost 338,000 page views.

http://www.elOnionBloggle@Blogspot.com

Nothing like pretending that there is a new type of pneumonia and shutting everything for months on end and wasting huge amounts of resources for snot “tests” and billions in useless jabs (useful just for making billions in profit for big pharma complex).

And after that – still ongoing collective stupidity – there is also nothing better to do than to apply sanctions to ourselves that destroy everything that still wasn’t destroyed the past 2+ years!

Probably these morons in government “thought” that Russia would capitulate quickly to this nonsense.

Oh well!

Lets all enjoy our collective stupidity and see our awesome way of life go up into ice crystals.

Can’t wait for the COLDEST WINTER in history, 2022/2023! Crossing fingers.

Do not forget my fellow MMS/3i’s that the SRF & Billionaires want to reduce the size of the global herds of MMS/3i’s and for Them anything goes.

Another thing you can do beside raising interest rates is control reckless spending. Or perhaps instead of.

If you don’t have energy, you do not have an economy.

It’s as bloody simple as that.

This is excellent from Brian Berletic: the US Rand corporation – despite warmongering being its raison d’etre – predicted in 2019 that provoking a conflict with Russia in Ukraine would be a military, economic and political disaster. It is proving exactly that.

https://youtu.be/uqVPM0KSUpo

Consequences of Greenie stupidity

https://oilprice.com/Energy/Energy-General/Energy-Shortages-And-Inflation-Threaten-Civil-Unrest-In-Europe.html

[…] The European central bank (ECB) has also moved too slowly in raising its interest rates. On September 8th, it is expected the ECB will raise the rate another 0.5%. Too slowly, some experts warn.No Tricks Zone […]

[…] The European central bank (ECB) has also moved too slowly in raising its interest rates. On September 8th, it is expected the ECB will raise the rate another 0.5%. Too slowly, some experts warn.No Tricks Zone […]